Life Insurance Quotes Online: Find the Best Rates Easily

Finding the right life insurance policy can feel overwhelming, but accessing life insurance quotes online simplifies the process significantly. By comparing quotes from various insurers, individuals can identify policies that meet their financial needs and provide peace of mind for their loved ones. The internet offers a wealth of resources that enable consumers to assess different coverage options without the pressure of a salesperson.

Shopping for life insurance online empowers individuals to make informed decisions at their own pace. Whether seeking term, whole, or universal life insurance, potential policyholders can evaluate multiple plans through straightforward platforms. This approach not only saves time but also fosters confidence in choosing the most suitable coverage.

Navigating the world of life insurance can be tricky, but it is essential for ensuring financial security. By utilizing online resources, prospective buyers can demystify the process, equipping themselves with the knowledge needed to select the right policy for their unique situation.

Understanding Life Insurance

Life insurance provides financial protection for beneficiaries in the event of the policyholder’s death. It can take various forms, each designed to meet different needs. This section explores the types of life insurance, the advantages of obtaining quotes online, and the mechanics of how online quotes work.

Types of Life Insurance

There are primarily two types of life insurance: term life insurance and whole life insurance.

- Term Life Insurance: This type provides coverage for a specific period, usually 5 to 30 years. It pays a death benefit only if the insured passes away within that term. This option is often less expensive, making it suitable for those on a budget.

- Whole Life Insurance: This offers coverage for the insured’s entire life, provided premiums are paid. It also includes a cash value component that grows over time. Whole life insurance typically comes with higher premiums but offers lifelong protection and potential borrowing options against the cash value.

Benefits of Getting Quotes Online

Obtaining life insurance quotes online offers several advantages.

- Convenience: Individuals can compare multiple policies from various providers at their own pace without pressure.

- Accessibility: Online tools allow users to access information anytime, making it easier to gather necessary details.

- Cost-Effectiveness: Online platforms often provide competitive pricing, allowing users to identify the best deals. For example, the average cost for a 20-year term policy for a healthy individual can be as low as $205 annually, as indicated by Forbes Advisor.

How Online Quotes Work

The process of obtaining life insurance quotes online is generally straightforward. First, the individual fills out a form with personal details such as age, health status, and desired coverage amount.

Next, algorithms match this information with various insurers’ databases to generate quotes. This enables users to receive estimates in real-time, allowing for easy comparison. The quotes typically reflect the individual’s risk level, influencing the premium rates offered.

By utilizing online platforms, potential policyholders can efficiently navigate their options and make informed decisions.

Choosing the Right Policy

Selecting a suitable life insurance policy involves understanding several key factors. Careful consideration of personal needs, financial goals, and available options is critical for making an informed decision.

Factors Influencing Insurance Rates

Several factors affect life insurance rates. Age plays a significant role; younger individuals typically enjoy lower premiums. Health status is another crucial aspect. Insurers assess medical history, lifestyle habits, and pre-existing conditions.

Occupation and hobbies may also influence rates. For instance, high-risk professions or activities such as skydiving can lead to higher premiums. Additionally, coverage amount and policy type, whether term or whole life, significantly impact rates.

Overall, a thorough examination of these factors aids in identifying suitable policies that meet financial and personal needs.

Comparing Quotes from Different Providers

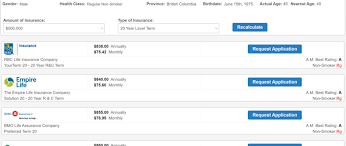

Obtaining quotes from multiple providers is essential for finding the most competitive rates. Online marketplaces, like Policygenius, allow individuals to easily compare options.

When comparing quotes, it’s important to consider coverage limits, policy features, and premiums. Some insurers offer additional benefits such as accelerated death benefits or riders for chronic illness.

In addition, examining the terms and conditions associated with each quote offers insights into potential costs. Various providers may have different underwriting guidelines, leading to discrepancies in quotes for similar coverage amounts.

By comparing multiple options, individuals can secure the best policy tailored to their specific needs.

Evaluating Insurance Company Ratings and Reviews

Assessing an insurance company’s reputation is vital before committing to a policy. Ratings from organizations like A.M. Best or Standard & Poor’s provide insight into a company’s financial strength and stability.

Customer reviews and testimonials can also illuminate the experience others have had with the insurer. Key aspects to consider include claim processing efficiency, customer service quality, and overall satisfaction.

Researching companies through resources such as the Better Business Bureau (BBB) can reveal any complaints or issues. Engaging with reputable insurance brokers can further help validate the credentials of various providers, ensuring informed choices are made.

Also Read :