Budget Insurance Login: Easy Access to Your Policy Management

Navigating the world of insurance can often feel overwhelming, but Budget Insurance simplifies the process with its streamlined online account management. Users can easily access their insurance policies, update details, and make payments through the Budget Insurance login portal. This convenience allows policyholders to manage their car, home, van, and life insurance policies anytime, anywhere.

The Budget Insurance login page is designed to provide a secure entry point where individuals can view important documents and make necessary changes to their coverage. After registering with an email and password, users can take full advantage of the features available within their account. This includes the ability to renew policies and download documents, ensuring that everything is at their fingertips.

Whether one is looking to view a quote or access specific policy details, the Budget Insurance online platform is user-friendly and efficient. Understanding how to utilize this resource can significantly enhance the experience of managing one’s insurance needs.

Accessing Your Budget Insurance Account

To successfully manage a policy with Budget Insurance, accessing your account online is essential. Users can create a new account or log in easily, while understanding common troubleshooting strategies can enhance the experience.

Creating A New Account

Creating a new account with Budget Insurance is straightforward. Users must first visit the Budget Insurance registration page and enter the email address used during the policy purchase. After inputting the email, they will be prompted to create a secure password.

It is important to choose a strong password to protect sensitive information. Once these steps are completed, an email confirmation may be sent. Following the confirmation, users can access their My Account area, where policy management is made simple and accessible anytime.

Logging In: Step-By-Step

Logging into a Budget Insurance account is a quick process. First, users should navigate to the Budget Insurance login page. Here, they must enter their registered email address and the password created during the account setup.

Care must be taken to ensure that both credentials are correctly input. If the information is accurate, users will gain access to their account. In cases where the password is forgotten, the “Forgot Password” option provides a way to reset it via their registered email, enhancing ease of access.

Troubleshooting Login Issues

If users encounter difficulties while logging in, a few troubleshooting steps can help. Confirming that the correct email address and password are being used is paramount. Users should also check for common typing errors, such as unintentional spaces.

In instances of forgotten passwords, the reset option is vital. If problems persist, contacting Budget Insurance customer support is advisable for further assistance. Keeping account details updated can prevent login complications, ensuring a smoother experience when managing policies online.

Managing Your Insurance Policies Online

Managing insurance policies online provides convenience and accessibility. Policyholders can easily track their coverage details, access important documents, and update personal information through a secure online platform.

Overview of Policy Management Features

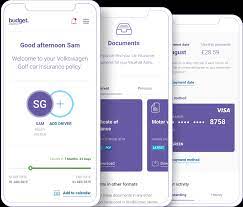

Budget Insurance offers several key features that enhance the online management experience. Through the My Account portal, users can view all their policy documents at any time. This feature includes policy details for car, van, home, and life insurance.

Users can also make payments, check coverage levels, and download necessary documents. Notifications about renewals or policy changes can be received via email or through the portal.

The intuitive design allows users to navigate seamlessly, ensuring they find the information they need without hassle. Accessing documents 24/7 provides reassurance and control.

Updating Personal Information

Keeping personal information current is crucial for effective policy management. Budget Insurance enables users to update their contact details, address, and other relevant data easily.

To modify personal information, users simply log into their account and navigate to the profile settings. Here, they can edit their information and save the changes.

Regular updates are important to ensure that communication remains seamless. Users should also review their insurance policy details periodically to confirm that all information aligns with their current situation. This proactive approach minimizes potential issues with claims or service.

Frequently Asked Questions

This section addresses common inquiries related to Budget Insurance, offering insights into account access, customer service, quotes, and available insurance policies. Detailed answers are provided for specific questions to assist users effectively.

How can I log in to my Budget Insurance account online?

To log in to a Budget Insurance account online, users should visit the Budget Insurance website. They need to enter the email address associated with their policy and the password they created during registration.

Where can I find the contact number for Budget Insurance customer service?

The contact number for Budget Insurance customer service is available on their official website. Customers can navigate to the “Contact Us” section to find the relevant phone number for assistance.

What are the opening hours for Budget Insurance?

Budget Insurance typically operates during standard business hours. Customers can check their website for specific opening hours to ensure they reach out at the right time for assistance.

How do I get a quote for Budget car insurance in the UK?

To obtain a quote for Budget car insurance in the UK, individuals can visit the Budget Insurance website and provide their details through the quote request form. This form requires information such as vehicle details and driving history.

What types of life insurance policies are available through Budget Insurance?

Budget Insurance offers various life insurance policies, including term life and whole life insurance options. Each policy type comes with distinct features, allowing customers to choose based on their specific needs.

Where can I find reviews on Budget Insurance services?

Reviews on Budget Insurance services can be found on various consumer review websites and forums. Customers may also check social media platforms for personal experiences shared by other users.

Also Read :

- Miway Insurance 2024

- Hippo Insurance

- Pineapple Insurance 2024

- Naked Insurance 2024

- Homeowners Insurance